Contents

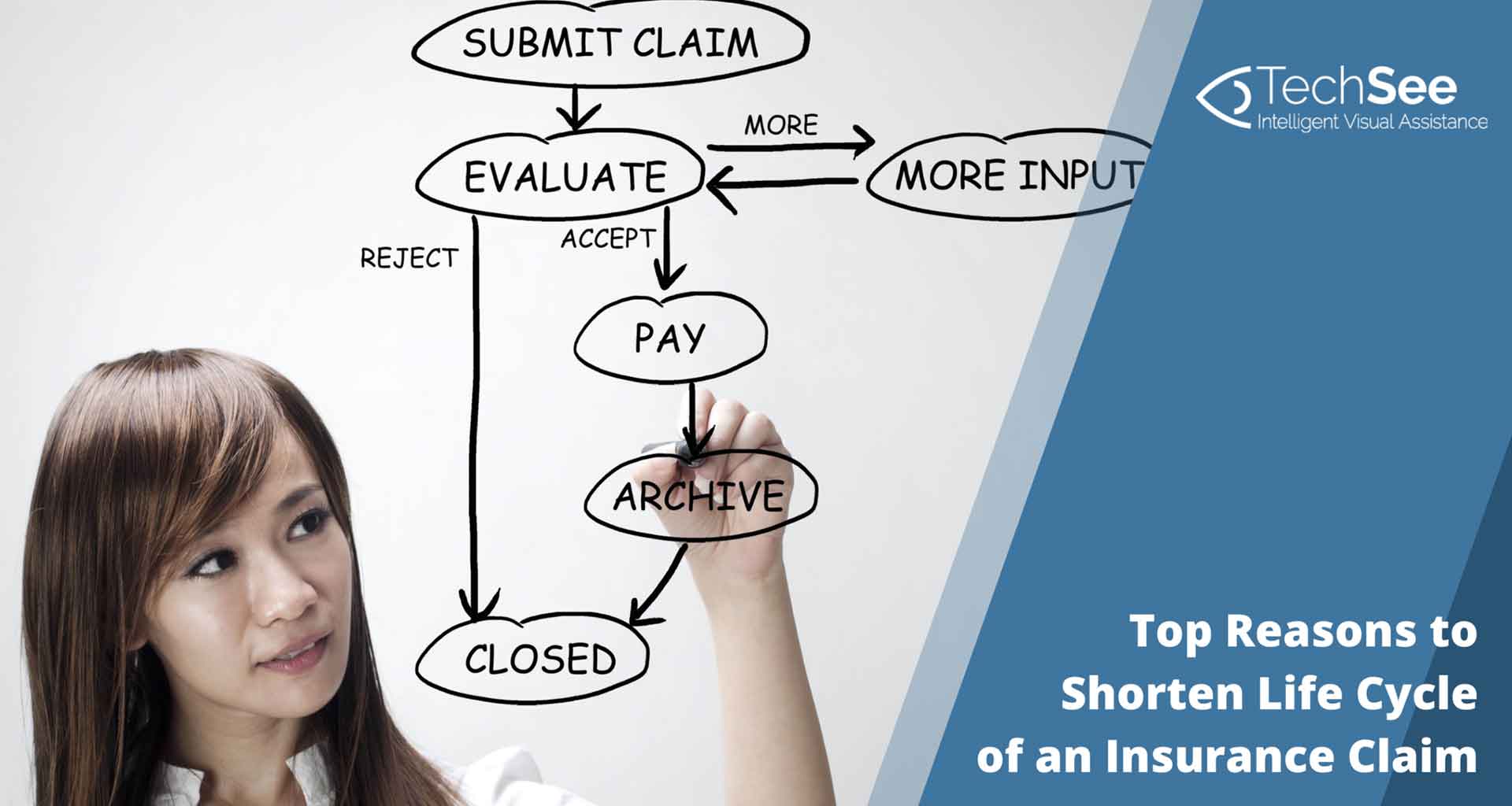

Insurance companies face the dual challenge of competing in an extremely crowded marketplace, while being required to constantly up their game in order to meet ever-rising customer expectations for a shortened life cycle of an insurance claim.

A key factor in the successful operation of any insurance company is the efficient processing of customer claims, a process that is often measured by KPIs such as claim settlement cycle time, claims processed per claim employee and most importantly, cost per claim.

Claims represent the largest single cost to insurers, and are considered a critical operational factor for P&L. At the same time, the efficiency and ease of the claims process plays a critical role in shaping customer sentiment and satisfaction.

Because of the high stakes around the claim life cycle, insurance companies have made significant investments in, and growth of, Insurtech solutions over the last decade. These technologies present unparalleled opportunities for improvement of the claims process, including the automation and visualization technologies that are transforming the insurance landscape.

Advantages of Insurtech Solutions

The Financial Advantage

According to research by Nuvento, claims – processing costs and payments – represent nearly 80% of a policyholder’s premium. The longer it takes to settle a claim, the higher the claim costs and the more it negatively affects the insurance company’s profitability.

By shortening life cycle insurance claims and keeping claim processing costs under control, an insurance company can price its premiums competitively without sacrificing profitability.

The Consumer Advantage

A claim represents a critical moment for the customer, who is often emotionally charged and stressed when facing hardship. These customers expect the same competitive level of customer service that is being offered by many other industries, raising the bar for insurers to meet their rising expectations.

When a claim is made, the insurance company has a small window of opportunity to provide service that will satisfy a customer – or not. If a claim is handled well, customer satisfaction and retention rates will rise. If a claim is handled poorly, the insurance company may not only lose the policy, but also damage its reputation in the process.

Negative claims experience ratings were highest for claims that took more than 20 days to be resolved. Finding ways to shorten the life cycle of insurance claims even beyond customer expectations can only serve to further strengthen customer loyalty.

The Competition Advantage

Like any mature market, insurance companies are seeking innovative ways to differentiate their offerings from the competition, and be more customer-centric in order to gain a competitive advantage. P&C insurers are increasingly automating processes by leveraging technologies such as artificial intelligence(AI) and robotic process automation (RPA). This has given rise to a new era of Insurtech companies, new players using technology to disrupt the insurance industry.

For example, Lemonade offers an innovative business model that is focused on a fast and efficient approval process, recently breaking all records by paying out a claim after only three seconds. Speed and efficiency is a critical factor for customers, as many people would opt to file a claim online if it would expedite the claims process.

The Infrastructure Advantage

The growing demand for customer-centric solutions coupled with mounting competition from non-traditional players cannibalizing market share with innovative business models, has forced the insurance industry to integrate digital technologies into their operations to keep pace. 49% of insurers have already integrated digital claims processing systems with first notice of loss (FNOL) systems. The shift to digital claims has been proven to increase efficiency; according to IMS, a digital claims function can drive a 20% increase in customer satisfaction score and 25-30% reduction in claim expenses.

Introducing Visual claims: Achieving a Shorter Insurance Claim

Implementing a visual engagement platform that enables visual insurance claims has emerged as an innovative technological solution that can transform the process of claim efficiency in a relatively short cycle of change.

What are visual claims?

Visual claims enable customers to transmit images and videos of their claims to contact center agents for immediate incident assessment. The video element is integrated into the existing workflow, in sync with existing systems, resulting in a more straightforward and significantly shorter life cycle of an insurance claims process.

Visual claims eliminate the requirement for a site visit, as well as the lengthy back-and-forth email communication between the agent and policyholder.

Benefits of Visual Claims

The adjuster has immediate access to real-time and objective visual information that may be temporary yet critical to the case, such as road conditions, position of vehicle, scope of damage in real time and other telling pieces of relevant information. This captured data can be used to make a quick decision at a critical moment or be used at a later date to expedite and resolve disagreements when necessary.

In situations that are not time sensitive, a policyholder can choose to upload images and videos of the damage for rapid, accurate assessment without the need for costly field work.

For example, if an insured heirloom was broken, the customer can simply upload images of the cracked piece at his convenience. Using either of these options allows the insurer to securely capture the evidence of loss documentation required to validate claims.

The integration of visual engagement into the claims process benefits insurance companies, large and small, by introducing efficiencies that shorten the life cycle insurance claims process. Visual claims often enable a higher percentage of first touch resolutions and in many cases, reduce the resolution time from 3-5 working days to minutes.

Visual claims deliver cost savings, improve customer satisfaction and provide a real competitive advantage using a digitized solution that can be implemented quickly and painlessly into existing workflows.

| Insurance Type | How Visual Claims Can Benefit Consumers |

|---|---|

| General insurance life cycle | Ability to send pictures of damage and shorten the claim life cycle for of the insurance policyholders. |

| Life cycle of a medical claim | Digitalizing the steps of a medical claim makes the insurance policy lifecycle management shorter and easier. Digitalizing the claim process can reduce operating expenses by 30%. |

| Auto insurance life cycle | Policyholders can video call an agent to show the vehicle and road conditions. A Clearcover survey indicates 55% of people in a car accident said if they were able to submit a claim digitally, it would have lowered the stress of being in the accident. |

Transforming Insurance Claims with Visual Technology

Claims processing is a key moment in the customer life cycle, and insurers have only a short opportunity to wow or disappoint their policyholders. With much at stake, insurers must adopt well-defined insurance policy lifecycle management supported by effective tools and technologies in order to transform the claims function.

Visual claims is an innovative technological solution that is easy to adopt, integrates into existing workflows and delivers real value to P&C insurers by providing a complete A-Z claims process in one touch within minutes.